Reinvention is hard. It’s an order of magnitude harder for companies successful in their industry, and exponentially harder for companies whose business depends on natural resources that are becoming scarcer and facing greater price volatility.

Nowhere is this more evident than in primary energy production – coal, petroleum, and natural gas. Exhibit A is BP. Despite an attempt, begun in the ’90s, to move “beyond petroleum”, BP quietly abandoned their attempts to reinvent their business by shutting down their flagship clean energy business, BP Solar, in 2011.

Yet energy companies need to reinvent their businesses with more urgency than most. I won’t make the full argument for why here, but in brief, it’s a combination of their “balance sheet” business model (i.e., their proven reserves are delivered to market, depleting their asset base) and increased pressure from many countries to de-carbonize their economy.

Fortunately, there’s a terrific example of successful reimagination not too far afield from primary energy production: BMW. BMW management has begun the process of transitioning from being a purveyor of motorcycles and luxury automobiles to being a mobility company. While not complete – and therefore not yet an iron-clad success story – BMW’s approach is instructive for the primary energy sector and others that seek to reinvent their business.

The process is fairly straightforward, but takes some time and a tolerance for controlled risk.

First, discover what problem you are solving for your customers. For BMW, it is providing aspirational mobility. For primary energy companies, it’s providing the energy their customers need to live their lives and run their businesses.

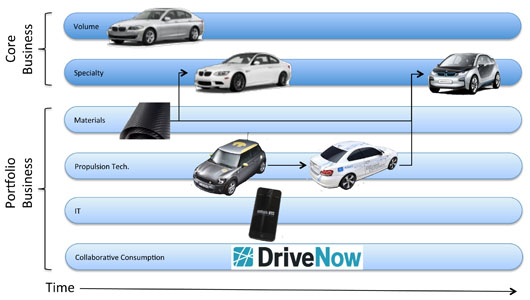

Once you’ve developed a solid hypothesis about the problem you’re solving, develop a portfolio of alternate solutions to this problem to test and learn from. Not every attempt at reinvention will succeed – dealing with this risk involves making numerous small bets and learning from your successes and failures. In BMW’s case, they invested in carbon fiber (to take weight out of their automobiles), EVs, car sharing, and even mobility IT. In primary energy, BP actually did a nice job of building a portfolio of potential alternative solutions to their customers’ energy needs.

Finally, use the market adoption curve to your advantage. Test your portfolio businesses with innovators and early adopters who are willing to tolerate “incomplete” products and willing to pay more to do so. For their EV effort, BMW rolled out several sequential test vehicles (see graphic above) and leased them to EV enthusiasts. Lessons from each test were incorporated in the next iteration with the goal of producing a “pure” EV within BMW’s core business. For primary energy producers, find companies like Walmart and UPS for whom energy is key to their business success and who are willing to take controlled risks to transition to cleaner sources of energy.

Understanding that learning is the whole point of this exercise is critical to doing it successfully. Ultimately, this is where BP fell down – they either undertook their clean portfolio as a cynical marketing ploy or (more likely) attempted to bring new technology and new business models to market at the same scale that they were used to operating on without understanding this stepwise process to reinvention.

Leave a Reply